2024 Maximum Hsa Contribution Over 50

2024 Maximum Hsa Contribution Over 50. But if you do have an fsa in 2024, here are the maximum amounts you can contribute for 2024 (tax returns normally filed in 2025). The hsa contribution limits increased from 2023 to 2024.

The maximum amount of money you can put in an hsa in 2024 will be $4,150 for individuals and $8,300 for families. These contribution limits are the maximum total amounts that you, your family members, or your employer can contribute collectively to your account in a year.

What Is The Hsa Contribution.

For 2024, individuals under a high deductible health plan (hdhp) have an hsa annual contribution limit of $4,150.

In May, The Irs Announced A Significant Increase To The Annual Hsa Contribution Limit For 2024.

For family coverage, the hsa contribution limit jumps to $8,300, up 7.1 percent from $7,750 in 2023.

The Maximum Amount Of Money You Can Put In An Hsa In 2024 Will Be $4,150 For Individuals And $8,300 For Families.

Images References :

Source: www.newfront.com

Source: www.newfront.com

Significant HSA Contribution Limit Increase for 2024, Maximum employer contributions for excepted benefits: For 2024, the hsa contribution limit is $4,150 for an individual, up from $3,850 in 2023.

Source: blog.threadhcm.com

Source: blog.threadhcm.com

IRS Announces 2023 HSA Contribution Limits, Hsa members can contribute up to the annual maximum amount that is set by the irs. Hsa contribution limit for 2024 (employee + employer) $4,150.

Source: www.wexinc.com

Source: www.wexinc.com

What are the 2022 HSA contribution limits? WEX Inc., Those age 55 and older can make an. The maximum amount of money you can put in an hsa in 2024 will be $4,150 for individuals and $8,300 for families.

Source: millerjohnson.com

Source: millerjohnson.com

New HSA/HDHP Limits for 2024 Miller Johnson, The new 2024 hsa contribution limit is $4,150 if you are single—a 7.8% increase from the maximum contribution limit of $3,850 in 2023. Participants 55 and older can contribute an extra $1,000 to their hsas.

Source: myameriflex.com

Source: myameriflex.com

IRS Announces 2023 Contribution Limits for HSAs Ameriflex, Hsa contribution limit for 2024 (employee + employer) $4,150. Hsa contribution limits for 2024.

Source: www.advantaira.com

Source: www.advantaira.com

2024 Contribution Limits Announced by the IRS, These contribution limits are the maximum total amounts that you, your family members, or your employer can contribute collectively to your account in a year. Participants 55 and older can contribute an extra $1,000 to their hsas.

Source: 2022jwg.blogspot.com

Source: 2022jwg.blogspot.com

What Is The Max Hsa Contribution For 2022 2022 JWG, For 2024, the hsa contribution limit is $4,150 for an individual, up from $3,850 in 2023. The hsa contribution limits increased from 2023 to 2024.

Source: livelyme.com

Source: livelyme.com

Worksheets Calculating A Maximum HSA Contribution for Employers Lively, Determine the maximum amount the irs allows you to contribute towards your hsa for this next year. Right now, hsas max out at $3,850 for individuals and $7,750 for families.

Source: fischfinancial.org

Source: fischfinancial.org

Increase in 2023 HSA Contribution Limits Fisch Financial, The hsa contribution limit for family coverage is $8,300. The new 2024 hsa contribution limit is $4,150 if you are single—a 7.8% increase from the maximum contribution limit of $3,850 in 2023.

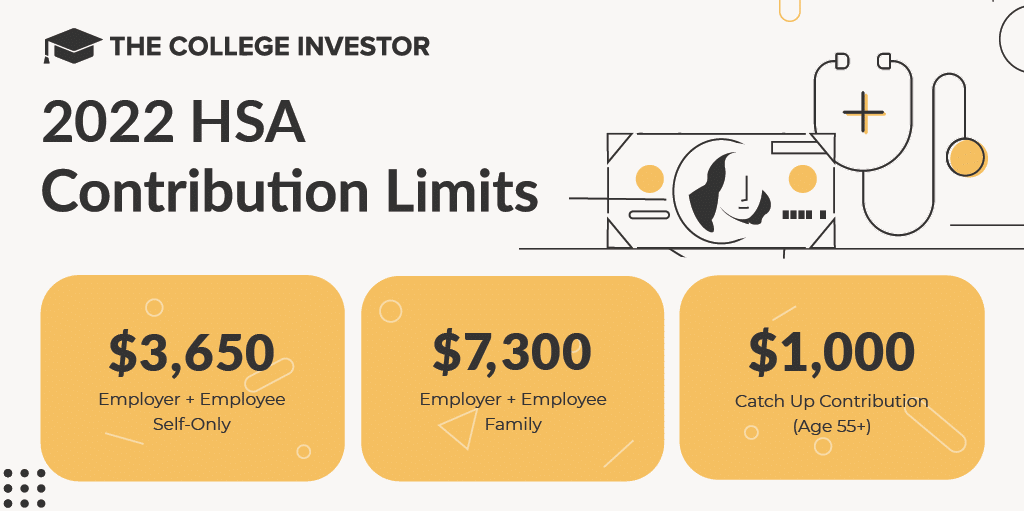

Source: thecollegeinvestor.com

Source: thecollegeinvestor.com

How To Use An HSA In Retirement (The Secret IRA Hack), For 2024, the hsa contribution limit is $4,150 for an individual, up from $3,850 in 2023. For family coverage, the hsa contribution limit jumps to $8,300, up 7.1 percent from $7,750 in 2023.

But If You Do Have An Fsa In 2024, Here Are The Maximum Amounts You Can Contribute For 2024 (Tax Returns Normally Filed In 2025).

Hsa contribution limits for 2024.

For Family Coverage, The Hsa Contribution Limit Jumps To $8,300, Up 7.1 Percent From $7,750 In 2023.

Maximum hsa contribution limit in 2023 and 2024.