2024 Gifting Amount

2024 Gifting Amount. The irs has announced that the 2024 annual gift tax exclusion is increasing due to inflation. The gift tax is intended to discourage large gifts that could potentially be used to avoid estate taxes.

Known as the annual gift tax exclusion, the amount for 2024 is $18,000 per individual or $36,000 per married couple. 11 spectacular stars unite for the 30th annual hollywood.

For 2024, The Annual Gift Tax Exemption Is $18,000, Up From $17,000 In 2023.

Net sales declined 1.1% in q4 and 3.4% for the year.

Annual Exclusion Per Donee For Year Of Gift

This year marks the highest annual gift tax exclusion amount yet.

A Married Couple Filing Jointly Can Double This Amount And Gift Individuals $36,000 Apiece In 2024.

For 2024, the annual gift tax limit is $18,000.

Images References :

Source: www.trustate.com

Source: www.trustate.com

IRS Increases Gift and Estate Tax Thresholds for 2023, This means you can give up to $18,000 to as many people as you want in 2024 without any of it being subject to the federal gift tax. For 2024, the annual exclusion amount for gifts increases to $18,000 (from $17,000).

Source: www.holidayscalendar.com

Source: www.holidayscalendar.com

National ReGifting Day in 2024/2025 When, Where, Why, How is Celebrated?, A married couple filing jointly can double this amount and gift individuals $36,000 apiece in 2024. Net sales declined 1.1% in q4 and 3.4% for the year.

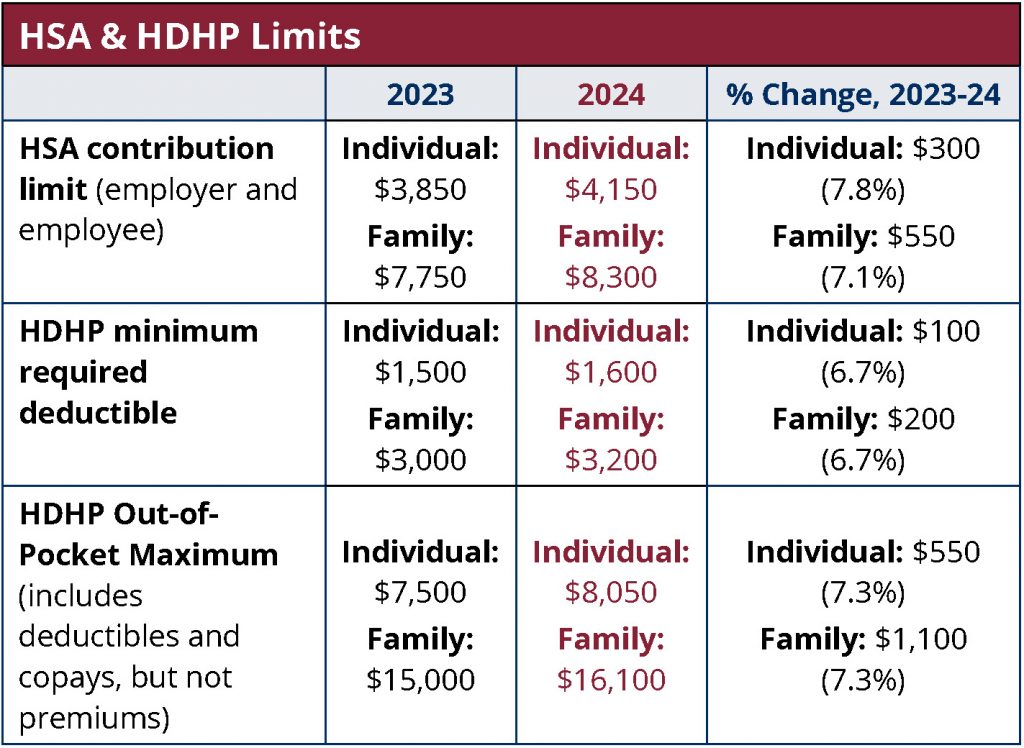

Source: www.medben.com

Source: www.medben.com

2024 HSA Contribution Limit Jumps Nearly 8 MedBen, Net sales declined 1.1% in q4 and 3.4% for the year. The united states government imposes a gift tax on gifts of money and other property that exceed the annual gift tax limit of $18,000 in 2024.

Source: theretirementcoach.org

Source: theretirementcoach.org

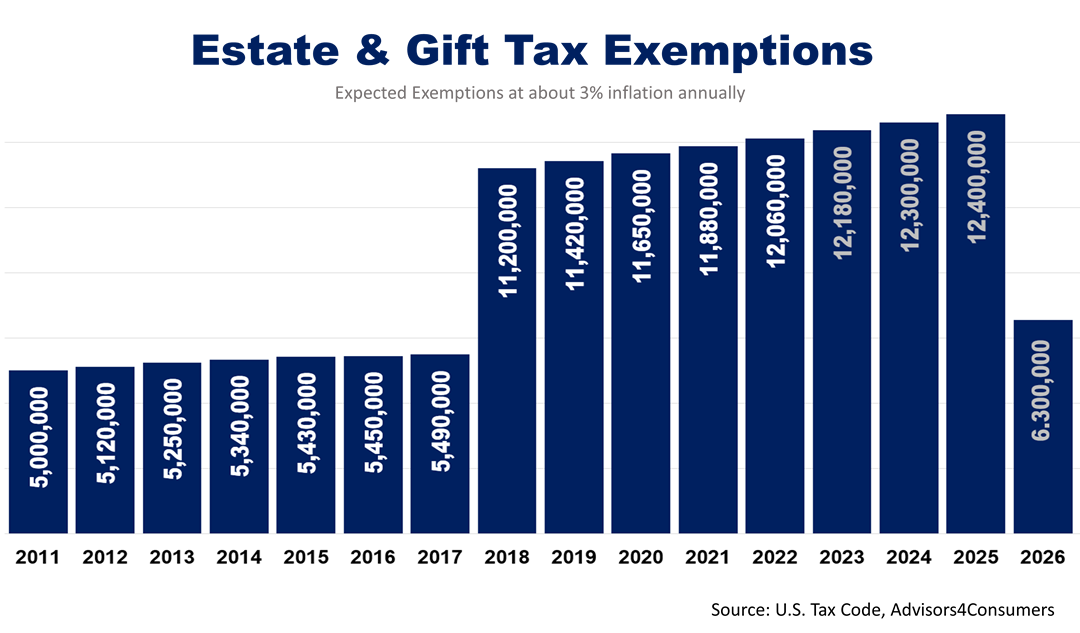

The Retirement Coach The Retirement Coach℠ 2022 Estate & Gift Tax, The annual gift tax exclusion in 2022 is $16,000. For 2024, the annual gift tax exemption is $18,000, up from $17,000 in 2023.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, As a result, any amount exceeding rs 50,000, received by an nri without consideration on or after july 5, 2019, was deemed to accrue or arise in india. Net sales declined 1.1% in q4 and 3.4% for the year.

Source: torange.biz

Source: torange.biz

New Year Gift 2024 Download free picture №212421, For 2024, the annual gift tax exclusion is $18,000, meaning a person can give up to $18,000 to as many people as he or she wants without having to pay any taxes on the gifts. The exemption from gift and estate taxes is now just above $13.6 million, up from about $12.9 million last year.

Source: www.evercorewealthandtrust.com

Source: www.evercorewealthandtrust.com

Gifting Time to Accelerate Plans? Evercore, The value of gifts made to any person (excluding gifts of future interests in property) that are not included in the total amount of taxable gifts under §2503 for the calendar year 2024 is. The gift tax is intended to discourage large gifts that could potentially be used to avoid estate taxes.

Source: www.youtube.com

Source: www.youtube.com

Social Security 2024 COLA Amount YouTube, The exclusion will be $18,000 per person for 2024. For 2024, the annual gift tax limit is $18,000.

Source: www.zabursaries.co.za

Source: www.zabursaries.co.za

SASSA Payment Dates for February 2024 All Grants, The exclusion will be $18,000 per recipient for 2024—the highest exclusion amount ever. The annual gift tax exclusion will be $18,000 per recipient for 2024.

Source: www.officialtrump2020store.com

Source: www.officialtrump2020store.com

Trump 2024 Gift Bundles, Sales, Promotions, For the 2024 tax year, taxpayers can deduct $14,600 if they are single and $29,200 if they are married and file jointly. In other words, if you give each of your children $18,000 in 2024, the annual exclusion applies to each gift.

Gifting More Than This Sum Means You Must File A Federal Gift Tax Return In 2025.

The gift tax is intended to discourage large gifts that could potentially be used to avoid estate taxes.

The Annual Gift Tax Exclusion Will Be $18,000 Per Recipient For 2024.

If current law expires, the federal lifetime tax exemption amounts will be cut roughly in half.

All The Glam From The Oscar Party Red Carpet.

The estate and lifetime gift exemption has also increased from $12.92 million to $13.61 million per individual.

Posted in 2024